Economic Model

pSWAN's economic model ensures solvency and incentivizes growth through an automated, utilization-based approach:

- Core Invariant:

pSWAN_total_supply <= SWAN_amount + delegated_amount + liquidating_amount- This ensures each pSWAN is always redeemable for 1 SWAN token

- SWAN_amount: Balance in liquidity pool

- delegated_amount: SWAN tokens delegated to service providers

- liquidating_amount: Tokens under liquidation (exempt from rate calculation)

Key Components

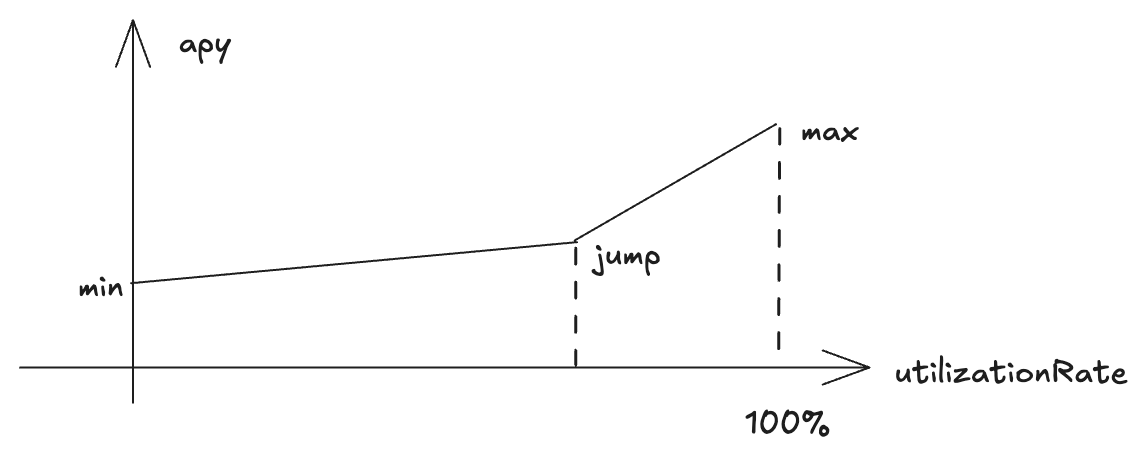

- Utilization-Based Miner Rate:

- Rate automatically adjusts based on pool utilization

- Utilization = delegated_amount / pSWAN_total_supply

- Minimum rate: 35% at utilization 0%

- Jumping point: 45% at utilization 90%

- Maximum rate: 100% at utilization 100%

- Collateral and Liquidation:

- Collateral factor: 80% - amount of the collateral that can be used for delegation request

- Liquidation threshold: 85% - threshold of LTV (loan to value) for liquidation

- Example

- CP with an account of collateral 100

- Max delegation it can request for is 100 * 80% = 80

- If CP requested max 80, overtime as the interest accrues, and it never repay such that requested amount exceeds 85 (100 * 85%), liquidation starts

- Procotol will stop the agent, start the process of withdrawing the collateral and return the delegation

Bootstrap Process

For new service providers without existing collateral:

- CP deposits initial amount (e.g., 20 SWAN)

- Requests delegation for additional amount (e.g., 80 SWAN)

- Combined amount used to set up node (100 SWAN total)

- Bootstrap value tracked on-chain

This enables CPs to start with lower upfront capital while maintaining protocol safety through collateral requirements and automated rate adjustments.