Interest Rate Model

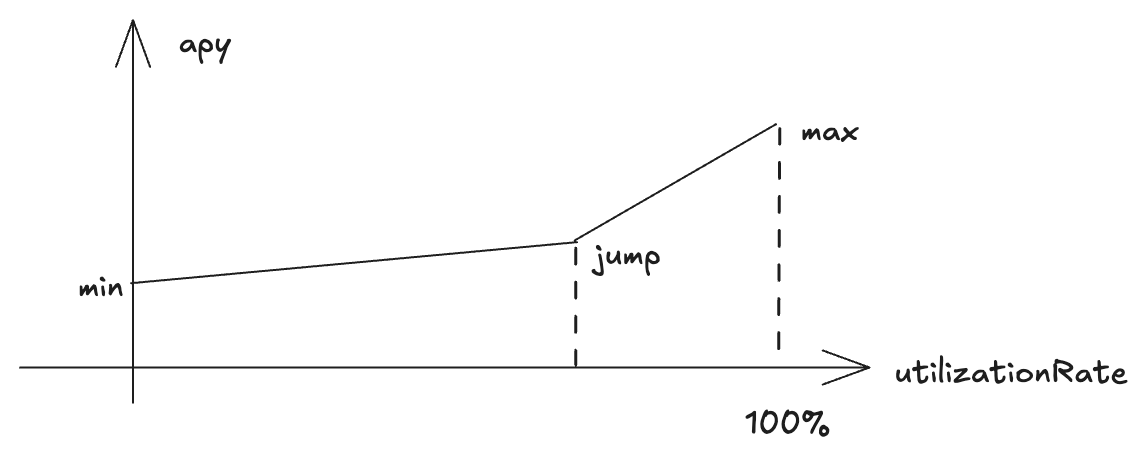

The Parasail protocol uses a Jump Rate model for interest rates, which is designed to optimize capital efficiency while maintaining protocol stability. This model adjusts interest rates based on the utilization rate of the pool.

Overview

The Jump Rate model consists of three key rate points:

- Minimum Rate: 12% (at 0% utilization)

- Jump Rate: 17% (at 90% utilization)

- Maximum Rate: 35% (at 100% utilization)

How It Works

-

Base Rate (0-90% Utilization)

- Starting at 12% when the pool is empty

- Increases linearly as utilization increases

- Reaches 17% at 90% utilization

- Encourages early participation and stable growth

-

Jump Point (90% Utilization)

- A significant increase in rates occurs at 90% utilization

- Helps prevent the pool from reaching maximum capacity

- Signals to users that the pool is approaching full utilization

-

Maximum Rate (90-100% Utilization)

- Rates increase sharply from 17% to 35%

- Provides strong incentives for users to:

- Withdraw funds when rates are high

- Deposit additional funds to earn higher returns

- Maintain sufficient liquidity for withdrawals

Benefits

-

Capital Efficiency

- Lower rates during normal utilization encourage borrowing

- Higher rates at high utilization prevent over-borrowing

- Optimal balance between lending and borrowing

-

Protocol Stability

- Prevents the pool from reaching 100% utilization

- Maintains sufficient liquidity for withdrawals

- Reduces the risk of liquidity crises

-

User Incentives

- Clear signals for optimal deposit/withdrawal timing

- Predictable rate changes based on pool utilization

- Fair distribution of rewards across all participants

Example Scenarios

-

Low Utilization (30%)

- Interest rate ≈ 13.67%

- Encourages borrowing and pool growth

- Stable returns for lenders

-

Medium Utilization (70%)

- Interest rate ≈ 15.89%

- Balanced borrowing and lending

- Moderate returns for all participants

-

High Utilization (95%)

- Interest rate ≈ 26%

- Strong incentives for withdrawals

- High returns for remaining lenders

Impact on Users

-

Lenders

- Higher returns during periods of high utilization

- Stable returns during normal market conditions

- Clear signals for optimal deposit timing

-

Borrowers

- Lower rates during normal utilization

- Higher costs during peak demand

- Incentives to maintain healthy utilization levels

-

Liquidity Providers

- Enhanced rewards during high utilization

- Protection against extreme market conditions

- Better risk management through rate adjustments