Economic Model

pATH's economic model ensures solvency and incentivizes growth through an automated, utilization-based approach:

- Core Invariant:

pATH_total_supply <= ATH_amount + delegated_amount + liquidating_amount- This ensures each pATH is always redeemable for 1 ATH token

- ATH_amount: Balance in liquidity pool

- delegated_amount: ATH tokens delegated to service providers

- liquidating_amount: Tokens under liquidation (exempt from rate calculation)

Key Components

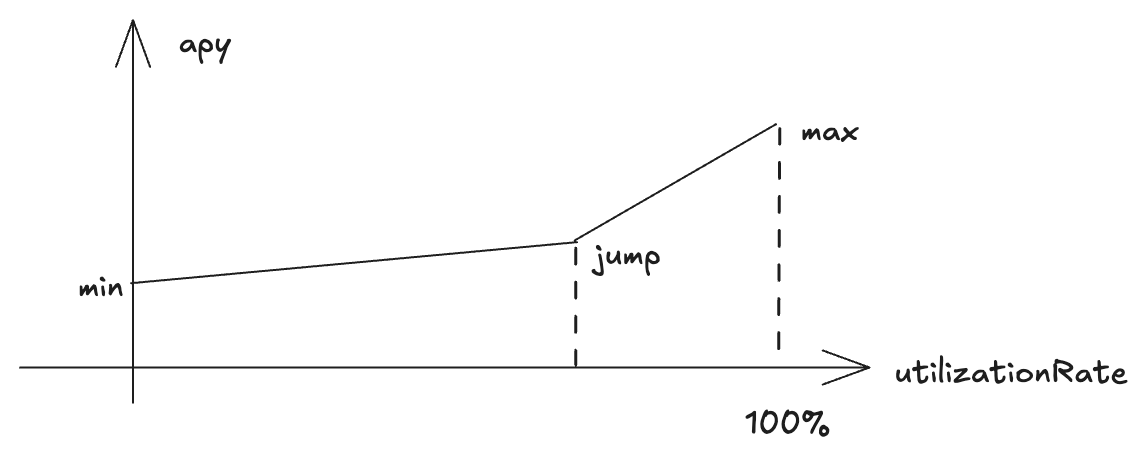

- Utilization-Based Miner Rate:

- Rate automatically adjusts based on pool utilization

- Utilization = delegated_amount / pATH_total_supply

- Minimum rate: 30% at utilization 0%

- Jumping point: 40% at utilization 90%

- Maximum rate: 70% at utilization 100%

- Collateral and Liquidation:

- Collateral factor: 80% - amount of the collateral that can be used for delegation request

- Liquidation threshold: 85% - threshold of LTV (loan to value) for liquidation

- Example

- SP with an account of collateral 100

- Max delegation it can request for is 100 * 80% = 80

- If SP requested max 80, overtime as the interest accrues, and it never repay such that requested amount exceeds 85 (100 * 85%), liquidation starts

- Protocol will stop the agent, start the process of withdrawing the collateral and return the delegation

Bootstrap Process

For new compute providers without existing collateral:

- SP deposits initial amount (e.g., 20 ATH)

- Requests delegation for additional amount (e.g., 80 ATH)

- Combined amount used to set up node (100 ATH total)

- Bootstrap value tracked on-chain

This enables SPs to start with lower upfront capital while maintaining protocol safety through collateral requirements and automated rate adjustments.